By Rex Womble

The “Starbucks effect” – which posits that several locations all within the vicinity of each other make customers crave coffee – has led to the ubiquitous coffee shops on every corner. The car wash industry has started to see similar clustering, along with a growing number of private-equity-held, multi-location companies.

Private equity firms often buy smaller businesses where the influx of capital they offer combined with strong business and financial management can lead to a large profit. Car wash locations have become a favorite target in recent years. Investors are looking to buy up independent operators to create local, regional, and even national car wash brands.

Car Wash Industry Ripe for Consolidation

In a very short period, the car wash landscape has changed dramatically as private-equity teams bought up former mom-and-pop car wash businesses.

There were more than 62,000 car wash locations in the United States in 2022. About a quarter of those are self-service, with the rest in-bay automatic or full-service washes. Data from 2019 suggested that about one percent of the nation’s car washes were owned by private equity firms.

When you look at recent acquisitions, a handful of large players – including Mister, Zips, and Driven Brands – have been responsible for 75 percent of the total transactions, representing more than 750 locations.

Private equity brings fresh capital that the car wash enterprise can use to grow through acquisition or greenfield development. Existing site acquisition usually allows companies to grow faster because the locations are already zoned for car wash. This prior zoning means less time spent with the city, and, depending on the state of the wash, there may be little to no downtime.

Margins and Membership Spurring Consolidation

Investors are often attracted to the financial upside they see in a car wash. Entrepreneurs figure they can reduce expenses with new operating procedures, adjusted labor strategies, and enhance marketing practices to increase volume through the site ultimately driving profitability.

Private equity firms look for industries with “recurring revenue,” meaning that customers are tied to the business, guaranteeing consistent income. Statistics show that people want to regularly wash their cars, with about two-thirds of car owners in the United States saying they wash their cars one to two times per month.

Car wash membership programs – further enhanced with the rollout of license plate recognition and RFID tags – appeal to private equity investors. These programs allow members to enjoy repeat car washes for a set price. By buying and rebranding mom-and-pop operations, investors create cross-membership compatibility where customers can redeem their membership at every location. Better yet, a strong membership program typically covers all debt of the business monthly with “retail sales” (non-members) being the cherry on top.

While interest rates have tempered investors’ excitement, the car wash industry remains resilient. Consumer car washing habits are consistent even in a down market. Throughout the pandemic, people continued to wash their cars, and many markets saw significant growth in their revenue.

Data is the “Edge”

Data will be critical as investors look to grow their car washes in this new environment. A sound understanding of the business’s financial standing will give investors the edge they need to grow capital efficiently and streamline workflows and processes.

But with each site acquisition comes potentially new point-of-sale and accounting systems – each with its own data reporting structure. In the past, car wash operators had the choice of adapting off-the-shelf solutions not built for the industry, creating their own data analytics from scratch, or drowning in a sea of separate reports and spreadsheets.

None of those options appeal to private equity investors because they combine higher costs with a less relevant stream of data. Because WashMetrix provides business analytics custom-built for the car wash industry, it’s the cost-effective, high-value option that marries car wash points-of-sale with the accounting system used by the operator.

By uniting disparate data across the value chain, WashMetrix can help investors and multi-site operators get a true picture of their finances unified with operations. With WashMetrix, companies can marry real-time, point-of-sale data with information from their accounting systems.

Investors and operators have easy access to a single source of accurate information in the WashMetrix system. This information allows them to make real-time operational decisions and create forward-looking financial projections to help manage expectations, identify discrepancies, and give site level management a deeper yet simpler understanding of their objectives. The software can go live in five to seven business days, giving car wash operators access to up-to-date operational information.

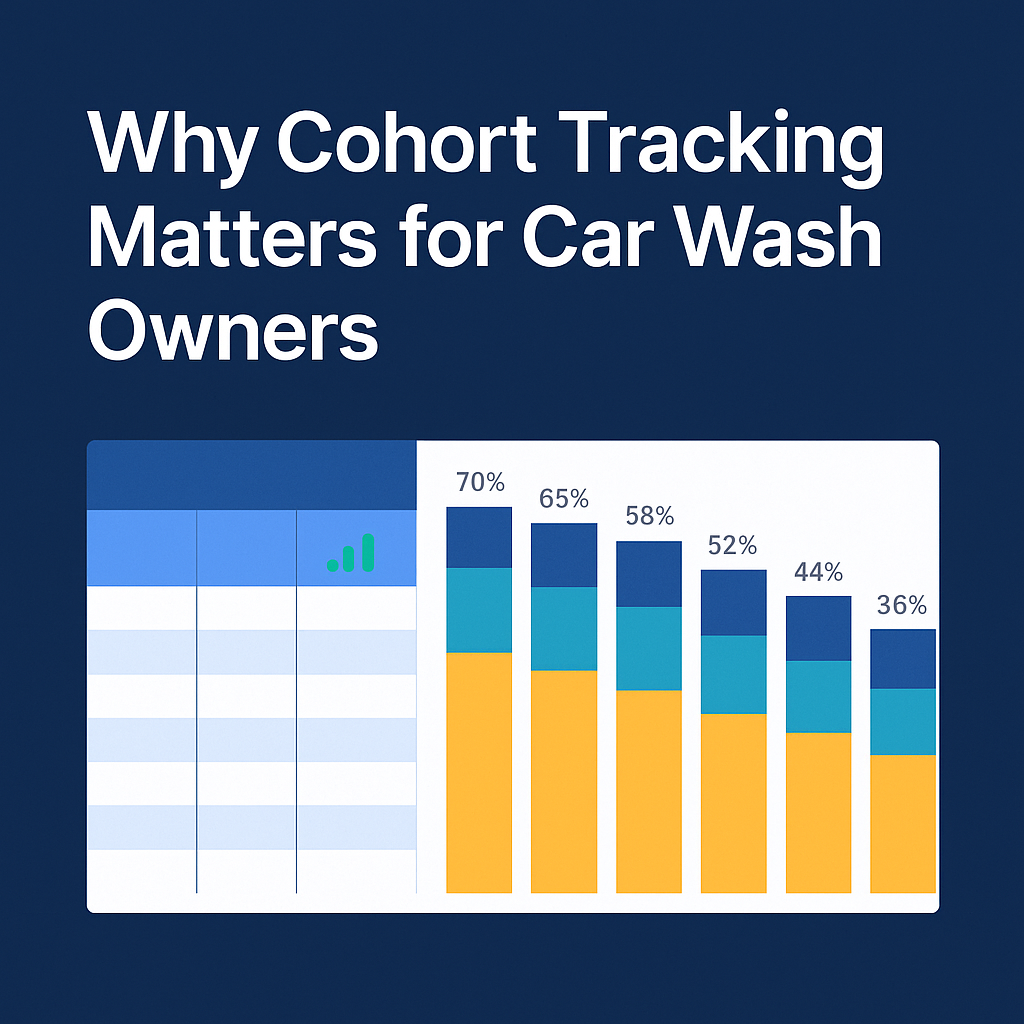

With WashMetrix, car wash operators can compare and analyze different points in time or different locations – all in the same dashboard within a click of a button. Built-in tile and module options for data visualization are geared specifically to the metrics and performance indicators that matter in the car wash industry.

Schedule a WashMetrix demo to find out more about how we can help you better understand your company’s financial and operational picture.